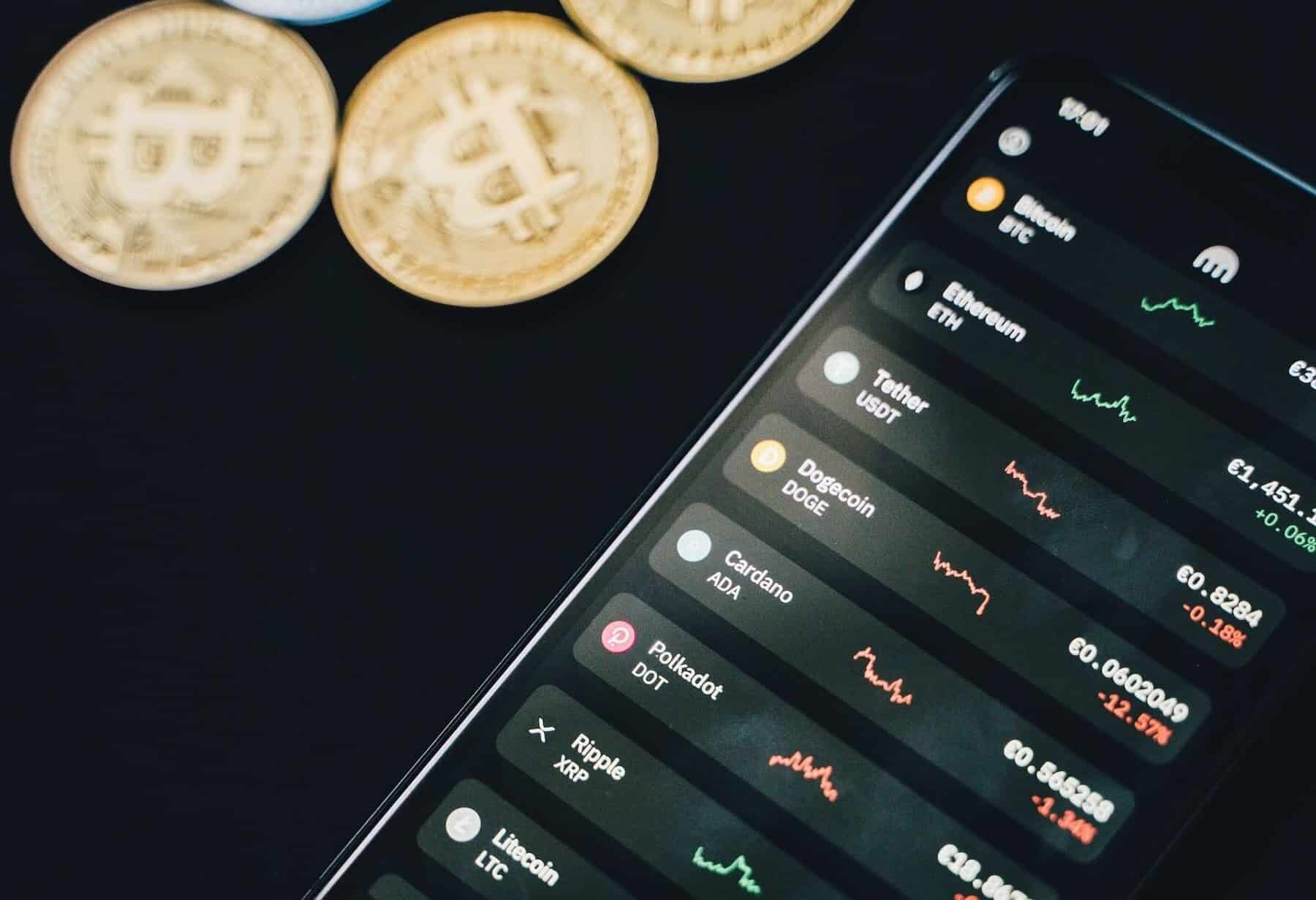

In the wild west of digital trading, pinpointing the most secure crypto exchanges is like finding a safe harbor in a storm. As a seasoned trader, I know the panic of a breached account all too well. That’s why I’m here to lift the veil on the sanctuaries of cyber trade. Security isn’t just a buzzword; it’s the cornerstone of any exchange worth its salt. We’ll crack the code on encryption, cold storage, and why your phone buzzing with a two-factor prompt is a sign of a fortress at work. Buckle up; we’re on a quest for bulletproof trading havens that stand guard over your digital treasures.

Assessing the Fortress: The Importance of Robust Security Measures in Crypto Exchanges

The Role of Encryption and Cold Storage in Protecting Digital Assets

We keep our cash in banks, right? So we must keep our digital coins safe too. The top-rated cryptocurrency platforms know this. They use tough encryption, like secret codes no one can crack, and cold storage. Cold storage means keeping digital money offline, away from thieves.

Some people ask, What is encryption? It’s like a lock only you have the key to. Secure digital currency trading relies on it to guard your coins. Imagine a vault where your digital money sleeps safe. That’s what encryption does. Cold storage takes it out of reach, in a place where hackers can’t touch it. Think of it as hiding your piggy bank where no one can find it.

Two-factor Authentication and Multi-Signature Wallets: The Frontline Defense

Have you heard of two-factor authentication in exchanges? It’s like having a secret handshake with your account. You need your password and another key, maybe a code from your phone, to get in. It keeps bad folks out because knowing one secret is not enough.

Now, let’s chat about multi-signature wallets in trading. These wallets need more than one key to open. It’s like needing both parents to say “yes” before you go out to play. This makes sure no one person can take the money and run. Reputed blockchain trading sites use it to keep everyone’s coins safe.

If you use a platform with these features, you’re on a high-security exchange platform. You’re trading where they care about your safety like a dragon guards its treasure. Trustworthy crypto exchange features make all the difference.

Safe trading is like wearing a seatbelt. You hope you don’t need it, but you’ll be glad it’s there. Imagine all the traders together, keeping each other safe. That’s what happens when everyone uses these safeguards. Hack-resistant crypto marketplaces are the strong castles of the trading world, and we make sure those walls are sky-high.

How do these fortresses prevent attacks? They stay alert. Crypto exchange safety measures mean watching non-stop for threats. It’s like having guards on the wall, always ready. If something looks wrong, the alarm goes off. It keeps our digital treasures and secrets away from the bad guys.

Ever heard a story of a dragon losing its gold? Not when it’s guarded by the best! We must all look for these secure spots to trade. With armor like encryption and multi-signature wallets, we keep the kingdom of crypto safe and sound. And that, my friends, is what trading should always feel like.

Trust Through Compliance: How Regulatory Adherence Enhances Exchange Security

Navigating AML and KYC: More Than Just Acronyms

What are AML and KYC in crypto exchanges? They’re big deals for your safety. AML stands for Anti-Money Laundering. KYC is Know Your Customer. Both make exchanges more secure. How? They help to stop bad guys from doing dirty money business. Every top-rated cryptocurrency platform uses them. Why should you care? It keeps your money safe and crypto clean.

But you might wonder, “Are there more ways these rules help me?” Yes, tons. They guard your private info too! Trustworthy crypto exchange features like AML and KYC show the site plays by the rules. That means less risk for you. Secure digital currency trading needs strong rules. And that’s what AML and KYC bring to the table.

Think of it like this. Your friend wants to borrow your prized bike. But first, you check if he’s careful with things. That’s what exchanges are doing. They’re making sure everyone is on the up and up.

The Importance of Regular Security Audits and Compliant API Protocols

Remember when you check your bike’s brakes before riding? That’s an audit. Crypto exchanges do the same with security. Regular checks keep everything tight and right. What’s a security audit for exchanges? It’s like a health check-up for the platform’s security. It spots weak spots before they turn into troubles.

Secure trading API protocols are key too. Think about a secret club with a super secure handshake. The API is that handshake. It lets apps talk safely to the exchange. Without a doubt, high-security exchange platforms take this serious. You should too.

So, these audits and APIs are big deals. They help stop hackers and problems. Plus, they make sure you can trade with peace of mind. That’s what you want, right?

To sum it up, stick with exchanges that value rules and checks. They’re working hard to keep your cash and trust safe. That’s what makes them the safest P2P cryptocurrency exchanges around. Always go for these smart choices.

Insuring Your Investments: The Critical Nature of Finance Security in Crypto Trading

Balancing Risks: The Role of Insurance Coverage in Trading Platforms

What is insurance protection in trading platforms? This means a safety net for your coins. If a hacker gets in, insurance can help cover your loss. This isn’t just good for peace of mind. It’s a must-have for top-rated cryptocurrency platforms.

When you use a platform with insurance, you know they take security serious. They’ve got money riding on keeping your trade safe. Not all sites do this. So, always check if they’ve got cover before you start.

Think of insurance as a big, strong wall around your digital cash. Even if bad guys try, they can’t easily break in and take your stash. But remember, insurance has limits. It might not cover every single coin you own.

Decentralized Exchanges: Are They the Safe Havens of the Future?

Now, let’s chat about decentralized exchanges. Some say they’re the best spots to trade digital cash. They spread out data, keeping it off a single target. This makes it hard for hackers to strike.

Wondering about “decentralized exchanges with high security”? They don’t hold your coins – you do. It means you’ve got more control but also more to handle. You need to know about keys and how to keep them safe.

On these platforms, you trade direct with others. It’s peer to peer, cutting out the middle guy. They use smart contracts, which are like unbreakable promises in code. Plus, they don’t know who you are. Your private info stays private.

These places often skip the tough setup of standard banks. But some may lack the insurance cover you find with big names. So, you trade off ease for less backup. It’s about what feels right for your cash and peace of mind.

Remember, staying safe while trading isn’t just a one-time thing. You need to always be on guard. Whether it’s with insured platforms or decentralized networks, the aim is the same. Keep your cash out of the bad guys’ hands and trade without fear.

Preparing for the Worst: Strategies for Mitigating Threats and Responding to Breaches

Crafting a Disaster Recovery Plan Tailored for Cryptocurrency Exchanges

When a storm hits, you want your ship to stay afloat. Think of a disaster recovery plan as a lifeboat for crypto exchanges. It’s a must-have to keep your trade safe when things go south. First off, know your weak spots. Work out how crashes and hacks could mess with your trade. Make a step-by-step plan to get back on track fast.

This plan should tell you who does what if trouble strikes. It needs clear actions to fix whatever broke. Keep backup gear and know how to switch to it quick. Work this plan often. Like a drill. So, when a real mess hits, you’re ready to act.

Train your crew too. They should get the game plan. Make sure they know their roles cold. If they need new skills, teach them. Prepping your team is as key as having the plan itself. They’re the ones who will bring your exchange back from the brink.

Stash your treasures well. Use cold storage for most of your coins. It’s offline so it’s harder to get at. For the hot wallet, that’s online, keep less in there. It’s riskier since it’s hooked up to the net.

Always back up your data. If you lose it, you’re in deep trouble. Regular backups save you from total loss. Store copies in different places. Some should be far from your main site. Disasters can hit whole areas hard, not just one spot.

Real-time Monitoring and Penetration Testing: Staying Ahead of the Curve

Do you wait for a flood to fix the dam? No way! Same for securing your crypto exchange. Watch over your exchange all the time, not just now and then. They call it real-time monitoring. It hunts for weird stuff that could mean trouble. If something fishy pops up, you can jump on it fast.

Now, let’s talk testing your walls. You need to hit your own system like a bad guy would. This is what they call penetration testing. Try breaking into your exchange. Find weak spots before real crooks do. Plus, when you know your system’s tough, you can brag about it to your users. It’s a win-win.

Calling all tech wizards! Run these tests a lot. The bad guys don’t rest, so neither can you. New threats pop up all the time. Stay ahead, keep testing.

None of this is just ‘nice to have’. These steps are life or death for your exchange. Let’s face it. It’s not about ‘if’ something will go wrong. It’s ‘when’. If you aren’t ready, it’s all over. But with a solid disaster recovery plan and real-time monitoring, you stand your ground. Even better, use what you’ve learned from tests to build a tougher, smarter system. Here’s the golden rule: Always prep for the worst, and work to make sure it never comes.

In this post, we covered why strong security is key for crypto exchanges. From encryption and cold storage to two-factor authentication and compliance with regulations, we must protect our digital assets. We also looked at how insurance can help balance the risks in crypto trading. Plus, we learned that decentralized exchanges might be safer options moving forward.

Finally, we went over plans to stay safe if things go wrong, like having a recovery plan and doing regular security checks. These steps are not just extras; they’re must-haves for any serious trader or platform. Remember, staying secure in the fast-moving crypto world takes constant work, but it’s worth it. Be wise, be safe, and keep investing smart!

Q&A :

What features define the most secure crypto exchanges?

When assessing the security of a crypto exchange, look for features such as two-factor authentication (2FA), end-to-end encryption, cold storage options for digital assets, insurance policies against theft or hacking, and a track record of regulatory compliance. The presence of robust security protocols like multi-sig wallets and real-time monitoring systems also contribute to the exchange’s overall security stature.

How do I choose a secure cryptocurrency exchange?

To choose a secure cryptocurrency exchange, consider the exchange’s security measures, user reviews, and any history of security breaches. Evaluate the platform’s customer support responsiveness and whether they provide educational resources for safe trading practices. Always check if the exchange is registered with relevant authorities and complies with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

Can a crypto exchange’s security be compromised?

Like any online platform, crypto exchanges can be vulnerable to security breaches. However, the most secure crypto exchanges employ advanced security measures to mitigate these risks. These measures can include implementing regular security audits, employing dedicated cybersecurity teams, and ensuring the infrastructure is updated to defend against the latest cyber threats. Users must also follow best practices to maintain their account security.

What are the most secure crypto exchanges available today?

The most secure crypto exchanges are often those with a strong reputation for security and regulatory compliance. Exchanges like Coinbase, Binance, and Kraken are frequently mentioned for their comprehensive security measures. It’s important to review the current security measures of any exchange as they are continually updated to adapt to new security challenges in the crypto market.

How important is insurance for a crypto exchange’s security?

Insurance serves as a crucial safety net for a crypto exchange’s security. It can protect users’ funds against potential losses due to security breaches or theft. Exchanges with insurance policies can offer users greater peace of mind, indicating a level of preparedness and financial stability in the event of unforeseen circumstances. Always verify the specifics of an exchange’s insurance coverage for clarity on what is and isn’t covered.

Remember to update these entries periodically to ensure the information remains current with industry trends and security updates.