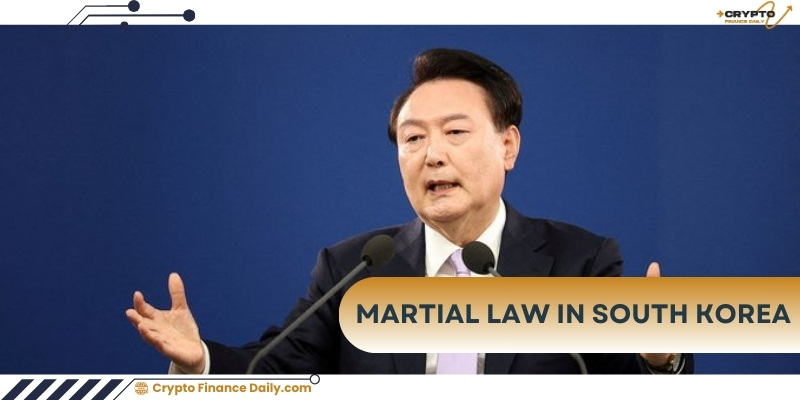

South Korea is experiencing one of the most politically tense events in its modern history. On the evening of December 3, 2024, President Yoon Suk Yeol declared a state of emergency martial law, citing threats from pro-North Korea forces. This decision has not only sparked significant domestic controversy but has also caused waves of volatility in the financial markets, particularly in the sensitive cryptocurrency sector, which is highly reactive to political changes.

Reasons behind South Korea’s martial law

President Yoon Suk Yeol stated that martial law is “a necessary measure” to safeguard freedom, constitutional order, and national security. In a nationally televised address, he emphasized that pro-North Korea forces are threatening to undermine South Korea’s democratic foundation.

The emergency measures include strict media control, restrictions on freedom of speech, and expanded military authority. These actions have drawn sharp criticism from human rights activists and opposition lawmakers.

Under martial law, the South Korean government has tightened information control, enforcing stringent regulations to suppress any activity perceived as a threat to national security. However, these measures have created widespread domestic anxiety and disrupted financial markets.

Impact of martial law on financial and cryptocurrency markets

Volatility in the cryptocurrency market

Immediately after the President’s announcement, South Korea’s cryptocurrency market saw unprecedented activity. According to Arkham Intelligence, a staggering inflow of $163 million USDT was recorded on the Upbit exchange within just one hour.

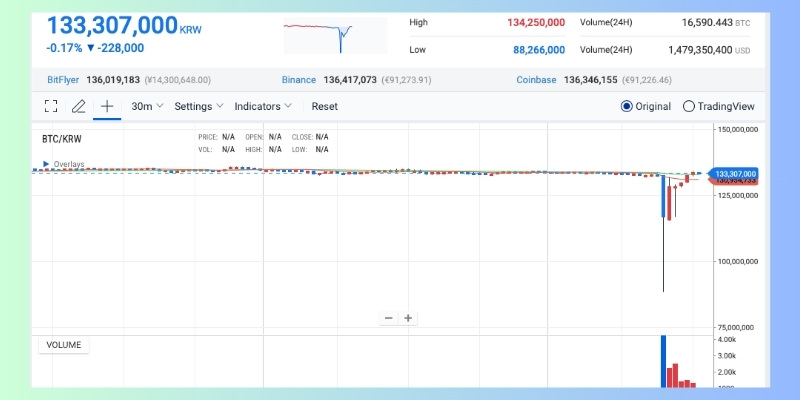

This surge indicates that investors are seeking stable assets like stablecoins to preserve value amidst uncertainty. Meanwhile, Bitcoin experienced sharp price swings:

- Dropping to a brief low of $71,814.99 USD.

- Rebounding to $96,347 USD as market sentiment gradually stabilized.

The panic-driven trading environment has amplified volatility, particularly as large-scale investors quickly adjusted their positions.

Effects on traditional financial markets

The impact of martial law extended beyond cryptocurrency to traditional financial markets:

- The South Korean won experienced a slight depreciation against the USD in international trading.

- The stock market faced selling pressure, especially in sectors vulnerable to political risks.

Reactions from key stakeholders

The South Korean national assembly

Following the declaration of martial law, the National Assembly convened an emergency meeting and passed a resolution urging President Yoon Suk Yeol to revoke the decision. South Korean law mandates that the President adhere to the Assembly’s resolutions on martial law-related matters.

However, President Yoon has yet to issue an official response, further escalating political tensions.

The Cryptocurrency community

The cryptocurrency community, both domestically and internationally, has voiced concerns about potential information control and government intervention. Ki Young Ju, CEO of CryptoQuant, warned that media censorship could pose significant risks for local investors.

He also advised investors to transition to international exchanges to ensure safety and mitigate risks from local policies.

South Korea’s martial law is not just a significant political event but also a catalyst for dramatic volatility in financial and cryptocurrency markets. Amid this uncertainty, investors are advised to remain cautious, stay informed, and adopt effective asset protection strategies.

Stay tuned to Crypto Finance Daily for the latest developments so you don’t miss out on investment opportunities in this challenging environment.