Hot wallets vs cold wallets: which should you choose to keep your crypto safe? Imagine standing at a crossroads, your digital wealth in hand, deciding between paths of hot and cold storage. It’s a crucial choice that affects your crypto’s security and its ease of use. In this article, we break down the ins and outs of each storage method. We’ll explore the various types of wallets available and give you the lowdown on how they function. With cyber threats on the rise, knowing the weak spots of hot wallets can save you a fortune, and we’ve got the inside scoop. Plus, we’ll lay out the robust shield cold wallets offer and walk you through setting one up. Stay ahead in the crypto game with this guide.

Understanding Cryptocurrency Storage: Hot vs Cold Wallets

Defining Hot and Cold Storage Options

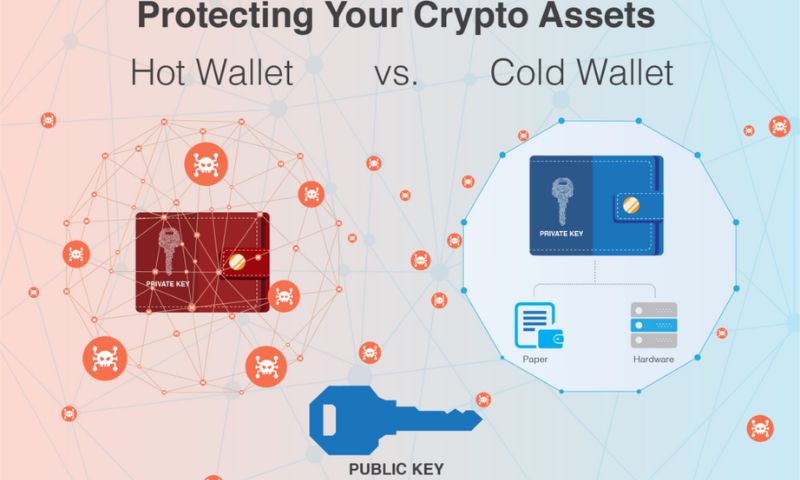

Think of hot and cold wallets like houses and safes. Hot wallets are like houses without locks; they’re easy to get into, which means they’re great for quick use but not so safe for storing valuable stuff. Cold wallets, on the other hand, are like the best safes out there — tough to crack and super safe, but not as quick to open when you need something fast.

Hot wallets are connected to the internet, which makes them super handy for buying and selling crypto in a snap. But, because they’re online, they’re also at risk of hacking, just like how a house without good locks might be. To keep your hot wallet safe, it’s all about strong passwords, and thinking about security just like you’d make sure your house is locked up tight.

Cold wallets, though, are offline, so they’re not easy targets for thieves. They’re like those fancy safes with layers of steel and locks. No internet means no online theft. But, they also take more work to set up and use, kind of like how it takes time to unlock all those safe layers.

The Different Types of Crypto Wallets and Their Functions

Now, let’s talk types of wallets. For hot wallets, you’ve got things like mobile, desktop, and web. Mobile wallets let you pay with crypto straight from your phone. Desktop ones sit on your computer and give you more control. Web wallets are on crypto exchanges and websites, ready for action.

Cold wallets come in varieties too, like hardware wallets, paper wallets, and USB wallets. Hardware wallets are little devices that hold your crypto offline. Think of them as mini safes you can carry around. Paper wallets are just pieces of paper with your crypto keys printed on them — basic, but very hacker-proof. Lastly, USB wallets are just like regular USB sticks, but they hold your crypto keys offline.

So, what’s the better choice? It comes down to what you need. For daily stuff, like paying for a coffee with Bitcoin, hot wallets are your go-to. They make life easy. For big sums or long-term holding, though, cold wallets are the champs. They’re like the bank vaults for your digital gold.

Remember, no matter which you choose, it’s all about the keys — your public and private keys. They’re like the address and key to your crypto house or safe. Keep them secret and safe, because if they get stolen, so does your crypto. Always back up your keys and consider multi-signature wallets for an extra layer of safety. And hey, if you’re feeling old school, a paper wallet might just do the trick.

In the end, choosing between hot and cold storage is about balancing convenience with security. It’s your crypto, so think about how you use it and what makes sense for you. Keep it simple and secure, and you’ll be all set.

Weighing Security and Accessibility in Wallet Choices

The Vulnerabilities of Hot Wallets and Best Practices for Protection

Hot wallets are easy to use but they can be risky. They are online which means hackers may attack them. Still, you need your hot wallet to be safe. So, use strong passwords and two-step checks, like codes on your phone. Look at the security that your wallet offers. Check if they keep some money offline. This helps if they get attacked. Don’t keep more crypto in your hot wallet than you need. This lowers risk.

With these wallets, keeping up to date on security is key. That being said, you might scratch your head and ask, which wallet is online? That’s a hot wallet! It’s always on the web. It’s ready for trades or to buy stuff. This means fast access but also more danger. A hacker wants what you have. If they find a weak spot, they might break in. This is why picking the right wallet is big. Choose one that has a name for being very safe.

The Strengths of Cold Storage and How to Set it Up Securely

Cold wallets keep your crypto off the web and safe. They aren’t as quick to use as hot wallets, but they offer strong safety. To set up a cold wallet, buy a trusted brand. You’ll transfer your crypto to this device. Then, it’s as if you took your money off the web and hid it in a safe place. No one can touch it as long as it’s offline.

A cold wallet can be a USB stick, a piece of paper, or a hardware wallet. When picking such a wallet, think of it like the bank vault for your crypto. It’s where you keep big amounts you don’t use every day. Make sure your private key—a secret code—stays secret. Write it down and put it in a safe spot, maybe even two places.

You might wonder, can’t I just hide my cold wallet and forget about it? Well, not quite. You must remember where you put it and also have secure copies of your key. If you lose your key, you lose your crypto!

A good plan for using a cold wallet is simple. For the money you plan to keep for a while, a cold wallet is smart. And for money you want to spend or trade, use a hot wallet, but with care. Keep looking for new ways to keep them safe.

Remember, when you’re setting up your cold wallet, think about how to recover it if needed. Can you get your crypto back if your cold wallet is lost or broken? Yes, if you have your key and maybe a backup. With planning, cold storage can keep your crypto safe for a long time.

Think of your hot wallet like a pocket wallet. It’s easy to get to, but you wouldn’t carry all your money in it. On the flip side, your cold wallet is like a safe. It’s not easy to open, but it keeps your wealth safe. It’s all about balance. Use both wallets to fit your life and how you use your crypto.

Choosing light or deep storage for your crypto means looking at your needs. Do you trade a lot, or are you keeping your crypto for the future? Hot wallets offer speed but watch out for risks. Cold wallets are slow to reach but very safe. Your choice will shape your crypto journey!

Analyzing the Best Wallet Features for Your Crypto Assets

Comparing Hardware, Software, and Mobile Wallet Solutions

When picking a wallet, think about your daily needs. Hardware wallets, like USB devices, keep your keys offline. This makes them safer from online attacks. Software wallets, on your computer or online, give you quick access but face higher hacking risks. Mobile wallets on your phone offer a balance: handy but riskier than hardware ones.

Software wallets may seem great due to their no-cost setup. But, remember your keys are online. This can invite hackers. Hardware wallets cost money but give top security. Still, they can be tricky to carry around. Mobile wallets are a middle ground. They make trading simple but can fall prey to phone hazards.

Always keep in mind how you plan to use your wallet. Will you trade a lot? If so, a mobile or software wallet might be your match. Not trading often? A hardware wallet could be best for your peace of mind.

Implementing Advanced Security Measures: Multi-signature and Encryption Techniques

Security in wallets is key. Your crypto stays safe if your keys are safe. What’s a key? It’s what you use to unlock your crypto stash. Private keys must stay secret. Public ones can be shared.

Now, let’s dive deep into safety. Encryption is a shield. It codes your data. Only you can decode it. Use strong passwords to shield your software wallets. And never share your codes. For extra walls of safety, there’s multi-signature. This requires more than one key to say ‘yes’ to a deal. It means more steps but more safety too.

When you set up a wallet, it’s wise to encrypt your private keys. This makes it hard for thieves to steal your crypto even if they get your device. Multi-signature technology is great for teamwork in crypto. It means you need another person to agree to send crypto. This keeps sneaky folks from running off with your coins.

Remember, in crypto, your safety is in your hands. You choose how to protect your digital coins. Picking the right wallet is like picking a safe for your gold. Make sure the lock is strong and you know how to use it. And always stay sharp – the world of crypto changes fast. Keep your safety gear on and your eyes open.

Maintaining and Recovering Your Cryptocurrency Investments

Strategies for Secure Crypto Transactions and Recovery Protocols

When it comes to cryptocurrency, keeping your assets safe is as crucial as owning them. Like a vault for your digital wealth, crypto wallets come in various forms. But here’s the trick: Whether you pick a hot wallet or a cold one, a solid backup plan is your best friend.

Keeping your crypto safe starts with secure transactions. Each time you trade, it’s essential to verify the web address, use a secure internet connection, and double-check wallet addresses. Phishing is a common way bad guys steal your crypto. They set up fake sites or wallets that look real but aren’t. Always check twice!

Backup comes in next. It’s like making sure you have a spare key to your house. If your wallet goes kaput or your computer takes a dive, you want a way back in, right? Exactly. So here it is: backing up is as simple as jotting down a seed phrase or copying your wallet file to a safe place.

What’s a seed phrase? Think of it as a master key. Usually 12 or 24 words long, it can restore your wallet if disaster strikes. Write it down on paper and put it somewhere safe—no, not on your computer or phone because they can get hacked or break down.

The Role of Seed Phrases and Backup Options in Asset Management

Backup options don’t stop at seed phrases, though. Some folks use USB drives, paper wallets, or even special devices to hold their crypto. But beware, these can get lost, damaged, or even stolen. Secure places and care with who knows about your backups are top priorities.

Storing your private key is another big deal. This is like the PIN code for your bank card. If someone else gets it, they can take your crypto. So never share it and keep it locked up tight.

How you set up your wallet matters too. Cold wallets are great for stashing crypto away. They’re like a safe deposit box—not super convenient for quick trades but solid for keeping your investments secure.

Hot wallets are on the flip side. People use them for daily trades because they’re easy to access. But, just like carrying cash in your pocket, they can be risky. They’re connected to the Internet, which means more chances for thieves to try their tricks. Keeping your hot wallet secure means changing passwords often, using wallets from trusted sources, and not storing more crypto than necessary for daily use.

When it comes to choosing, think of your wallet in terms of shoes. Hot wallets are like running shoes – perfect for day-to-day use. Cold wallets are your armored boots – less handy but way more protective.

Remember, in the crypto world, there’s no one to call if you lose access to your account. No bank manager, no customer service. That’s why setting up recovery protocols and keeping backups safe and secure is your number one job. It’s all about balancing convenience with security – making sure you can get to your assets when you need to but keeping them safe all the while.

We learned today that storing crypto can be safe or risky, and it’s up to you to choose. Hot wallets make access easy but can be open doors for thieves. Cold wallets are like vaults, hard to crack but not as quick to open when you need them. Balancing safety with getting to your money is key. Think of hot wallets like your pocket cash and cold ones as your savings account.

Remember, picking a wallet is about what you need. Hardware? Software? Your phone? Each has its own perks. And don’t skimp on security—use multi-signature and encryption to keep your digital dollars safe.

Lastly, be smart: keep your seed phrases safe and know how to get your crypto back if things go south. Your crypto journey relies on good choices—pick the best wallet, and always protect your digital treasure.

Q&A :

What is the difference between hot wallets and cold wallets?

Hot wallets are digital wallets that are connected to the internet and provide convenience for frequent transactions. They can be accessed through web interfaces, mobile and desktop applications, and are considered less secure due to their internet connectivity. Cold wallets, on the other hand, are offline storage solutions for cryptocurrencies. They include hardware wallets, paper wallets, and any form of storage not connected to the internet. Cold wallets are favored for their security, as they are less susceptible to hacking and online threats.

How secure are hot wallets compared to cold wallets?

Hot wallets, due to their constant internet connection, are more vulnerable to online attacks, such as hacking, phishing, and malware. They are often used for smaller amounts of cryptocurrencies that are traded or used regularly. In contrast, cold wallets are not connected to the internet, making them highly resistant to online threats and an excellent choice for storing large amounts of cryptocurrencies long-term. However, users must safeguard the physical device or paper to prevent loss or damage.

Why might someone choose a hot wallet over a cold wallet?

Someone might opt for a hot wallet over a cold wallet for several reasons. The primary reason is convenience, as hot wallets are accessible through the internet, making them suitable for daily transactions and trading. They often come with user-friendly interfaces and facilitate faster and easier exchanges. For individuals actively managing their cryptocurrency portfolios, the real-time access provided by hot wallets is critical. However, they usually manage smaller amounts of crypto due to the higher risk exposure.

Can cold wallets receive funds when they are offline?

Yes, cold wallets can receive funds even when they are offline. Transactions are made to the wallet’s public address which is not dependent on the wallet being connected to the internet. The funds will be seen as part of the balance once the cold wallet is connected or checked online. However, in order to send funds from a cold wallet, you have to connect it to a device or process that allows you to access the blockchain and sign the outgoing transaction.

What should I consider when choosing between a hot wallet and a cold wallet?

When deciding between a hot wallet and a cold wallet, consider the balance between convenience and security that is right for you. If you execute frequent transactions and value ease-of-access, a hot wallet may suit your needs better. For substantial savings of cryptocurrency that you don’t plan to use or trade frequently, a cold wallet is typically safer. It’s also wise to consider the amount of cryptocurrency you’re dealing with – higher amounts generally warrant stronger security measures like those provided by cold wallets. Additionally, evaluate the reputation and security measures of the wallet provider, whether hot or cold, to ensure your assets are well-protected.