In the world of digital currency, the battle of Custodial vs Non-Custodial Crypto Wallets is critical. Your choice can lock down or leave open your virtual vault of coins. Getting it right means knowing who holds the keys to your digital fortune. Do you trust a company, or do you keep that power in your own hands? Here, I unpack each type, so you can make a smart call on where your cyber cash sleeps at night. It’s your money; I’m just here to show you how to keep it safe. Let’s dive in and secure your stash.

Understanding the Basics of Cryptocurrency Wallets

Defining Custodial vs Non-Custodial Wallets

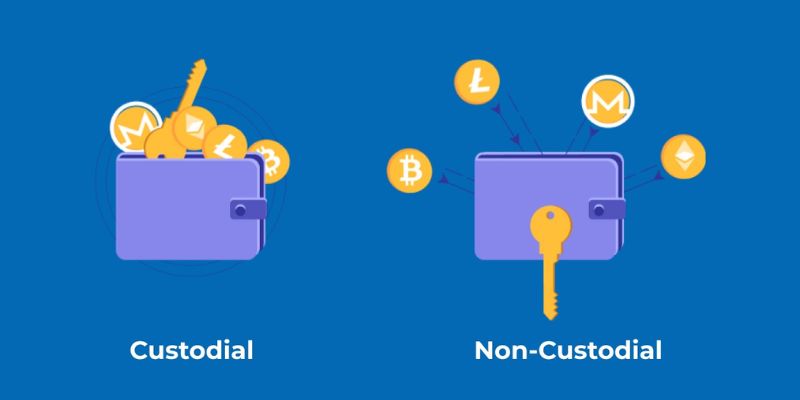

So, you want to keep your crypto safe? Smart move. Two main ways are custodial and non-custodial wallets. “Custodial” means a company holds your crypto for you. Think of it like a bank. They have your crypto, and they take care of it. But, just like a bank, if they get in trouble, your crypto might too. “Non-custodial” wallets are where you’re the boss. You hold your keys, nobody else. If you’re careful, it’s safer because you control everything. The big thing? Don’t lose your keys, or your crypto says bye-bye.

The Various Crypto Wallet Types

Now, let’s talk wallet types. There’s hot and cold. “Hot” wallets connect to the internet. They are super handy but can be risky since hackers like the internet too. “Cold” wallets? They’re offline. Think USB stick but for crypto. They’re safer because they are away from online thieves. Mobile wallets go on your phone, easy to use, but don’t lose your phone! Desktop wallets are for your computer – good security, but watch out for viruses. Hardware wallets look like a small device, super secure. Software wallets are apps or programs, nice and easy but keep your computer safe from hackers.

Oh, and if you like sharing control, “multi-signature” wallets need more than one key. It’s like needing two keys to open a bank safe. Good for teams or families.

Remember, whether it’s a physical device or a simple app on your phone, knowing your crypto wallet type helps you understand how to keep your digital treasures safe. Don’t just choose one because it seems cool. Think about safety, how easy it is to use, and yes, how it fits your life. If you take this seriously, your digital fortune can stay just that – a fortune.

The Implications of Control Over Your Crypto Assets

Who Holds the Private Keys?

When you store crypto, think about keys. Private keys are crypto’s secret codes. You may wonder, “Who really has my private keys in different wallets?” Well, it depends on wallet choice! Custodial wallets mean the service holds them. They keep your keys, sort of like banks keep your cash. Non-custodial means you’re in charge. Only you hold your keys, which feels super powerful.

Let me paint a picture for you: Imagine a locker that holds all your digital coins. With a custodial wallet, the locker key is in someone else’s hands. They open and close it for you. Trusting a custodial wallet service provider is a big deal. Stuff could go wrong like theft, or they might make bad moves. Now, if you pick non-custodial, that locker key? It’s on your keychain. You call the shots, no middle man.

Non-Custodial Wallet Advantages and Autonomy

Non-custodial wallet use gives you full control, no kidding. Imagine driving a car where you own the keys versus one you always borrow. Feels different, right? You are your own wallet guard. It’s true freedom.

Pros? Big ones. Security rockets up because only you can touch your crypto. No one else pokes around. Plus, they scream independence. Decentralized wallets, they’re called, don’t bank on banks or others. They trust in tech – blockchain, to keep it plain. These wallets also come in different flavors – think mobile and desktop options. You pick what fits you best.

But remember, with great power comes… You guessed it – great responsibility. If you lose access, your crypto is basically a treasure without a map. No backup means saying bye-bye to your digital fortune. Not fun, right?

Using a non-custodial wallet means you’ve got to ace managing digital assets. Get sharp on best practices like backups. Have your own plan if things get rough. Folks who lose access often learn the hard way that there’s no ‘forgot password’ link. Backing up your wallet is critical.

In closing, comparing crypto wallets, custodial vs non-custodial, is about who has the private keys. Storing cryptocurrency comes down to choice, control, and taking on duties. Whether you want a company to manage for you, or you handle it solo, knowing the difference is key – pun totally intended.

Each type’s got perks and dings. Non-custodial gives control, with a slice of risk. But hey, isn’t choice what crypto is all about? Choose well, stay safe, and you’ll shine in the crypto world.

Analyzing the Security Framework of Wallet Types

When it comes to storing cryptocurrency, the choice between custodial vs non-custodial crypto wallets is vital.

The Risks Associated with Custodial Wallets

Custodial wallets are often used by those new to digital asset security. They’re easy to use, and they’re offered by a range of crypto wallet providers. The problem? With a custodial wallet, you’re trusting a third party with your private keys. This means a breach at the custodial wallet service provider could lead to loss or theft of your funds. Risks of custodial wallets are not just about theft. They also include loss due to bankruptcy or closure of the provider.

In the case of custodial wallets, the keys to your crypto-wealth are held by a third party. You rely on them to follow best practices in crypto storage. This dependence is a stark contrast to the control over private keys you enjoy with non-custodial wallets.

Security Measures Unique to Non-Custodial Wallets

Non-custodial wallets keep you in charge. These wallets give you—all on your own—the task of managing your digital assets. Your private keys are yours alone, and you don’t need to place trust in a third party. This autonomy comes with its own challenges, of course, but also brings non-custodial wallet advantages.

Unlike custodial options, you’re not exposed to the risk of third-party failure. But if you lose your keys, your crypto assets are as good as gone. Recovery is close to impossible if you mishandle or misplace your keys. In the world of non-custodial wallet usage, you are your own security. This often involves hardware wallets, software wallets, mobile wallets, and desktop wallets for securing your crypto.

Many non-custodial wallet users also opt for cold storage wallets, storing their cryptocurrency without an internet connection. It’s the digital equivalent of hiding wealth in a safe versus a bank check. There’s also hot storage wallets, which are online and convenient but carry more risk.

Key management in crypto storage with a non-custodial wallet requires careful thought and planning. It involves best practices such as backing up your wallet and keeping a recovery phrase in a secure location.

The lesson here is clear. Whether you prefer the ease of custodial wallets or the control of non-custodial options, understanding the security framework is crucial. This way, you can make the best choice for your personal needs and secure your digital fortune against potential risks.

Practical Insights for Cryptocurrency Owners

Best Practices in Crypto Wallet Management

When securing your digital gold, knowing how to manage your wallet is key. With custodial vs non-custodial crypto wallets, the choice is like picking a safety box. Custodial wallets keep your crypto under someone else’s lock and key. Non-custodial wallets, though? They hand you the keys.

Think hard about who controls your keys. With a custodial service, someone else has them. That means you trust them to guard your treasure. With non-custodial wallets, you are the guardian. You get to call the shots. But you must be careful. If you lose your keys, you could lose your crypto for good.

Storing cryptocurrency should feel safe and right. Make sure to compare crypto wallet types. Ask yourself which features matter most to you. Security can change between wallets. Some protect you like a fortress. Others? More like a simple lock on a door.

With digital asset security, don’t cut corners. Use strategies like keeping a backup. It saves you from a world of worry if things go wrong. Remember, not all backups are the same. Some might be a piece of paper. Others are electronic. Knowing how to back up your wallet can save your digital assets.

Crypto wallet providers offer many choices. Do your homework; pick the right one for you. Look at how they manage your private keys. Remember, third-party control of crypto can mean less freedom for you.

For mult signature wallets, several keys unlock your funds. This spreads out the security. If one key is lost, you still have a backup. Or even two. This is like having several locks on your most prized container.

When understanding cryptocurrency storage, think about a mix of hot and cold storage. Hot wallets are connected to the internet. They’re easy to use. Cold storage wallets? They live offline. Harder to reach, but they can be safer.

Another key point: compare hardware wallets vs software wallets. Hardware wallets hold your crypto on a physical device. Software wallets are on your computer or phone. Both have ups and downs. Choose based on what makes you feel secure.

Steps to Recovering Your Crypto Wallet Contents

What if you lose access to your wallet? First, breathe. It’s not the end of the world. Non-custodial wallet recovery can be simple. Use your backup phrases or keys to unlock your wallet again.

With custodial wallets, it might take some extra steps. Contact your wallet’s service. They can guide you in getting back into your account. Always keep your account details up to date. If they need to verify it’s you, it will be much smoother.

Finally, understand that recovering lost crypto wallets can take time. Stay patient. Keep your cool. You’ve got this. Thieves might be out there. But with the right steps, your digital fortune stays within your reach.

Knowing is half the battle. Now, with these insights, your crypto journey can be as secure as you make it. Stay savvy!

In this post, we’ve learned the must-know facts about crypto wallets. We’ve looked at the difference between custodial and non-custodial wallets, explored the various types available, and dived into who really controls your private keys. We’ve also tackled the big question of security and how it changes with different wallet types.

To wrap up, the power to manage your crypto lies in your hands. With non-custodial wallets, you gain more freedom but also more responsibility. Remember, the care you put into managing your wallet can make all the difference. Lose your keys, and you could lose your crypto. But follow best practices, and you’ll not only keep your digital coins safe but also enjoy the autonomy that crypto was meant to offer. Make smart choices and stay secure in the ever-growing world of cryptocurrency.

Q&A :

1. What is the difference between custodial and non-custodial crypto wallets?

Custodial and non-custodial crypto wallets differ primarily in who controls the private keys to the assets stored within them. In a custodial wallet, a third-party entity, such as a cryptocurrency exchange, retains control of the private keys. On the other hand, in a non-custodial wallet, only the user has control over their private keys.

2. What are the advantages and disadvantages of custodial crypto wallets?

Custodial crypto wallets offer a level of convenience that’s usually not available with non-custodial wallets. This includes user-friendly interfaces, easy recovery of lost wallets, and sometimes even support for fiat currency and other services. However, they also come with associated risks, specifically in terms of security. Since the service provider has control over the private keys, the security of the wallet depends on their infrastructure, which can potentially be hacked.

3. What are the advantages and disadvantages of non-custodial crypto wallets?

Non-custodial crypto wallets offer increased privacy and security, as users have full control over their private keys. This design makes them immune to third-party data breaches. However, they also require the user to take full responsibility for the safe-keeping and backup of their private keys. Losing these keys can lead to irreversible loss of cryptocurrency, with no recourse.

4. How secure is a custodial vs non-custodial crypto wallet?

The security of custodial and non-custodial crypto wallets largely depends on the practices of the user and the service provider. Custodial wallets depend on the security measures implemented by the service providers. Meanwhile, non-custodial wallets offer robust security, dependent on the user’s ability to keep their private keys safe and protected.

5. Which type of crypto wallet should I use, custodial or non-custodial?

The choice between a custodial and non-custodial crypto wallet depends on individual requirements. If you value convenience, easy access, and support, a custodial wallet may be more suitable. But if you wish to have total control over your privacy and security, you may prefer a non-custodial crypto wallet.