Securing Your Digital Wealth Safely

Imagine a vault for your virtual coins that’s both sturdy and smart. That’s where types of crypto wallets step in. They’re not all made equal, though. Some are like a digital Fort Knox, others like an icebox where your e-cash stays cold. In this guide, we dive into the tech that keeps your tokens tight. Get ready to learn about hardware wallets that turn your crypto into a tough nut to crack with secure chips. Understand cold storage, where your digital dough gets a frosty, offline shield. We’ll also compare hot and cold wallets, showing you why temperature matters in the crypto space. And for those who play well with others, there’s the community vaults—multi-signature and decentralized wallets. Let’s unlock the secrets to crypto wallet safety, one click at a time.

Understanding Hardware Wallets: The Fort Knox of Cryptocurrency

Navigating the World of Ledger and Trezor

Imagine keeping your digital coins in a mini safe. That’s a hardware wallet for you. Hardware wallets explained simply: they are USB-like devices that store your crypto offline. A Ledger Nano usage tip: It’s just like a USB stick. But instead of holding pictures, it secures crypto. Trezor device features are similar. It’s another mini safe for digital coins. They all keep hackers away from your treasure.

Hardware wallets remind us of old piggy banks. But instead of coins, they store digital wealth. Using them is a step towards being your own bank. With great power over your coins, comes great responsibility for safekeeping. This means making sure you never lose your device or reveal your private keys – the secret numbers that unlock your coins. It’s like not giving out the combo to your safe.

The Role of Secure Chips in Enhancing Security

Have you ever wondered how these wallets keep crypto safe? Secure chips in hardware wallets are the answer. They’re like the ultimate guard dogs that never sleep.

The chips within check for any signs of tampering. They act as a shield against any tricks thieves might try. Even if someone gets their hands on your hardware wallet, these chips help ensure they can’t get into it.

Physical cryptocurrency storage gets safer with these chips. They’re the reason why hardware wallets are like Fort Knox for your digital coins. The technology is tricky to understand, but think of secure chips as mini bouncers. They prevent uninvited guests (hackers) from crashing your crypto party.

With hardware wallets, you can relax a bit knowing your digital wealth is under lock and key. Remember, while they are super safe, it’s still up to you to protect your treasure. Keep your hardware wallet hidden. And guard your private keys like they were gold. With a hardware wallet, only you can reach your precious coins.

That’s the beauty and power of owning a piece of crypto Fort Knox.

Exploring Cold Storage: The Icebox for Your Digital Assets

Crafting Paper Wallets for Offline Security

Think of a paper wallet like a secret map. It holds keys to your digital treasure. But, unlike a map, it’s hidden from hackers. Why? Because it’s not online. It’s just a piece of paper. This paper has two important parts. There’s a public address. You share this to get coins. Then, there’s a private key. This is secret. It’s what you use to access your coins.

To make a paper wallet, start with a website that generates them. One click and you have a new wallet. Pull it off the internet next. Print it out and now, it’s in your hands. Keep this paper safe, like cash or jewelry. Why? If it’s gone, so are your coins. No bank can help you get them back.

Remember not to stop caring for this paper. Water, fire, or just losing it could spell disaster. Think ahead. Make copies. Store them like the valuable items they are. Maybe even in a safe.

QR Codes and Physical Cryptocurrency Storage

A QR code for crypto is a secret door. Only your scanner has the key. It’s handy. It makes moving coins fast and mistake-free. You won’t mess up a long crypto address this way. You also keep your private key offline and out of reach from online threats.

Many use QR codes for safe trading. They come from the same place as paper wallets. When you print your wallet, print the QR codes too. One is for loading coins, the other for spending them. People scan the first one to send you money. The second one, you use in secret, to spend your coins.

Carry this QR code with you, but protect it like cash. Remember, anyone with the code can use your coins. You might think to put it in a phone or on a USB stick. That’s fine, but not as safe as paper. Phones break. USBs fail. Paper lasts if you care for it.

At the end of the day, this is about putting your coins in a place you trust. Yes, it’s old-school. But sometimes, old ways are good ways. Especially when you’re keeping your digital dollars safe from digital dangers.

So, start exploring these offline options. They might seem different at first. But in a high-tech world, going low-tech could be your smart move. You’re like a tech-wise pirate, hiding your loot from prying eyes. Set your course for safe shores. Your future self will thank you.

Navigating Hot and Cold Wallets: Accessibility vs Security

Hot Wallet Benefits and Digital Wallet Comparisons

Hot wallets are like pockets full of cash. They are easy to use. You can get to them fast, right through the internet. They hold your digital money – like Bitcoin. You’ve got different kinds – online wallets, mobile wallet apps, desktop ones too. Online wallets let you get to your coins from any device. Mobile apps are like having a bank on your phone. Desktop ones are great for folks who like their stuff in one place.

Now, think of the times you check your phone. That’s how often you could use a hot wallet. Still, that comes with a big “but”. Security. Hot wallets are safer than your pocket, sure. But hackers like them too. They’re always online, so the risks are higher. To stay safe, we need to be smart. Use strong passwords, think of two-factor authentication as your best buddy.

Cold Wallet Solutions and the Assurance of Private Key Safeguarding

Let’s flip the coin to cold wallets. They store your keys offline. Imagine them like buried treasure or a safe in the basement. They don’t touch the internet – not until you say so. This is cold storage. It’s like a vault for your virtual bucks.

People love hardware wallets. They’re like tiny vaults you can carry. The Ledger Nano or Trezor, ever heard of them? They make sure only you touch your coins. They use secure chips – think of them like guards for your gold. It’s all about keeping those sneaky cyber-thieves out.

Creating a paper wallet is like making a treasure map. It’s a piece of paper with all the secret codes (we call them keys). No electricity, no problem. The same goes for printed QR codes – zap, and your coins are where you need them. No online path for hackers here.

So when to use each? Use hot wallets for your walking-around money. Money you might need to tap or swipe anytime. Cold wallets are for your big stash. The money you don’t need right away. You lock it up and stay calm, knowing it’s tucked away.

Remember, private key safekeeping is top dog in the crypto world. That’s like knowing the only way into your secret bunker. Lose it, and say bye-bye to your stash. So, write down the keys or phrases that unlock your wallet. Store them like you would a birth certificate. Think safety deposit box, not your kitchen drawer.

Picking between hot and cold wallets is a dance. How often will you need to pay? How safe do you want your coins? It’s like picking shoes for the day – flip-flops for the beach, boots for the hike. Pick the right wallet for your journey, and you’ll be golden.

To sum it up, the name of the game is balance. Weigh how much you trade off between a wallet that’s there when you snap your fingers and a vault that’s locked tight. Find the middle path that’s just right for you. Keep learning, stay sharp, and don’t let those keys out of your sight!

Multi-signature and Decentralized Wallets: The Community Vaults

Implementing Multi-signature Systems for Enhanced Business Security

Imagine a bank vault that needs two keys to open. This is multi-signature in crypto. It means you need more than one private key to access funds. This keeps your business safe. If one person loses their key or tries to steal money, they can’t. The system stops them because they need the other keys too.

Multi-signature, or “multi-sig,” wallets are super for teams and companies. They split the power to move crypto between a few trusted people. It’s like having a group of guardians for your digital coins. Let’s talk about hardware wallets. They can store keys safely. Ledger Nano and Trezor are top choices here. These devices keep keys out of hackers’ reach.

We call hardware wallets, like Ledger and Trezor, “cold” because they stay offline. Cold storage means great protection. It’s like a safe that’s tough for thieves to crack. These wallets can even use secure chips, making them stronger against attacks.

Now, you might ask, “What if we lose a key?” Well, that’s where trust kicks in. Maybe you’re thinking, “What happens to our money?” Fear not! With the right backup strategies, your cash is safe. Always back up your keys and use fail-safes. Otherwise, it’s like leaving your vault door open, right?

The Evolution and Security of Decentralized Wallets

The world’s moving fast. Crypto’s now got decentralized wallets. They give power to the people, not the banks. You’re in charge of your cash. No middlemen, no waiting. You might be new to this. So, what’s a decentralized wallet? It’s a wallet where nobody but you holds your keys.

Decentralized wallets bring freedom. You can trade without asking anyone for permission. That’s huge, right? But with great power comes great responsibility. You must keep your keys like treasure. If you lose them, there’s no “forgot my password” button.

They work in a trustless environment. That’s a good thing. It means the system’s designed so you don’t need to trust anyone else. Not even if they seem nice. Your keys, your money — simple as that.

Can you use these wallets easily? Yes! Online wallets and mobile apps make it a breeze. Even so, never skip on the safety steps. Use seed phrases – secret codes that can bring back your wallet if things go wrong.

Public and private keys matter a lot. Your public key is like your home address but for crypto. Anyone can know it. But your private key? It’s the key to your house. Never share it. Keep it secret, keep it safe.

In the world of crypto wallets, smart choices keep you secure. Use strong passwords and think before you click. Your digital wealth is worth it. Remember, in crypto we trust — but we must verify too!

In our journey today, we dug deep into the safe worlds of hardware and cold wallets, where your digital coins stay secure. From the secure chips of Ledger and Trezor to crafting paper wallets, we’ve explored it all. We also weighed up hot and cold wallets, seeing how each serves your need for either quick access or strong security.

But that’s not all. We also checked out multi-signature and decentralized wallets, the big guns for protecting your digital treasure across a network of trusted hands.

Here’s my take: if your crypto is precious, treating it like a priceless jewel is smart. Pick a wallet that guards it like Fort Knox. Want peace of mind? Go for cold storage. Love quick access? Hot wallets can help. And if you’re all about that group trust, throw in some multi-signature and decentralized options.

Remember, your best bet is to choose what fits your crypto life best. Stay savvy, stay secure, and your digital wealth will thank you.

Q&A :

What Are the Different Types of Crypto Wallets Available?

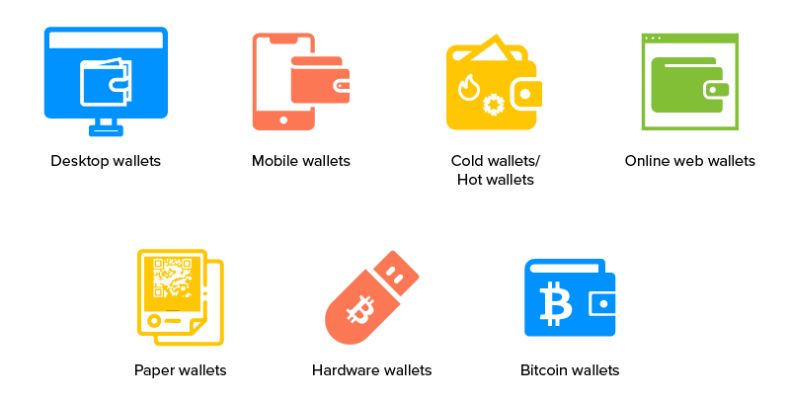

Crypto wallets come in various forms, primarily categorized based on their connectivity and how they store cryptographic keys. The main types are:

- Hardware Wallets: Physical devices that store private keys offline.

- Software Wallets: These include desktop, mobile, and online wallets.

- Paper Wallets: Physical documents that contain a cryptocurrency address and a private key, usually in the form of QR codes for ease of use.

Each type is designed for different use cases and levels of security.

How Do Hardware Crypto Wallets Enhance Security?

Hardware wallets offer enhanced security because they store private keys offline on a physical device. Transactions are signed within the device and then broadcast to the network, reducing the risk of hacking. Since they are not connected to the internet, they are considered the most secure form of crypto wallets, known as “cold storage.”

Can You Explain the Difference Between Hot Wallets and Cold Wallets?

Yes, the difference between hot and cold wallets pertains to their connection to the internet. Hot wallets, which include desktop, mobile, and online wallets, are connected to the internet and are more convenient for daily transactions. However, they are also more susceptible to online attacks. Cold wallets, such as hardware wallets or paper wallets, remain offline, providing increased security by reducing exposure to online vulnerabilities.

What Should You Consider When Choosing a Crypto Wallet?

When choosing a crypto wallet, consider the following aspects:

- Security: Assess the security measures provided, like two-factor authentication, multi-signature support, and backup features.

- Accessibility: How often you’ll need to access your funds and from which devices.

- Ease of Use: The user interface should be easy to navigate, especially for beginners.

- Supported Cryptocurrencies: Ensure that the wallet supports the cryptocurrencies you intend to use.

- Reputation: Research the wallet’s reputation within the crypto community and look for testimonials and reviews.

Taking these into account will help you select the right crypto wallet for your needs.

Why Might Someone Use a Paper Wallet and What Are Its Downsides?

Someone might use a paper wallet to store their private keys and public addresses because it is a form of cold storage that is not susceptible to online hacking attempts. The downsides of a paper wallet include the risk of physical damage or loss, difficulty in conducting transactions, and the need for secure storage practices. Additionally, they are not as convenient for frequent traders or those who need quick access to their assets.