Comparison of popular crypto exchanges is more than a trend; it’s a must for anyone looking to dive into digital currencies. As an expert, I’ve seen too many get lost in the maze of options. But you won’t. Today, I’m your guide to finding the top dog in this showdown. We’ll cut through the noise and lay out what makes an exchange stand above the rest. Do they make trading easy for newbies? Or leave them in a tangle of jargon and complex charts? Are you losing your coins in fees without even knowing it? And when the chips are down, is your chosen platform as secure as a vault? It’s time to find out which crypto exchange wears the crown!

Navigating the Crypto Exchange Landscape

Essential Features Across Platforms

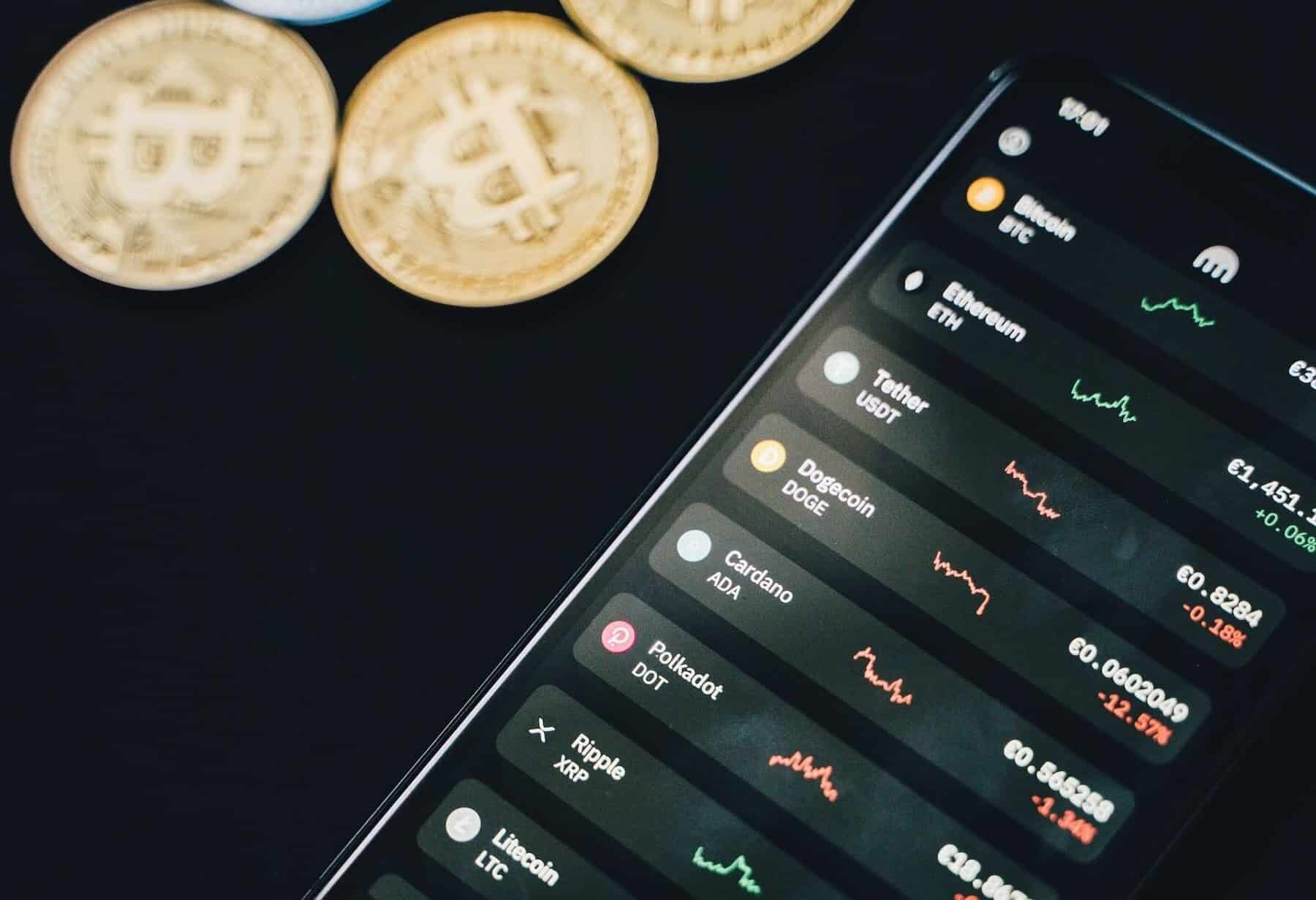

When you pick a crypto exchange, think of it as choosing a bank. It’s a big deal! You want a place that’s safe, easy to use, and has what you need. Just like banks, exchanges have loads of features. But what should you look for?

First, check out how many supported cryptocurrencies they have. More options mean more chances to trade and find cool coins. Crypto to fiat transactions are also key. You’ll want to change crypto to regular money without hassle.

For safety, strong security measures in crypto exchanges are a must. Think of it as a superhero shield for your money. And smooth deposit and withdrawal methods are super handy to move your money quick.

Don’t forget about fees! Exchange fees and rates can munch away at your funds if they’re too high. So, lower fees are always better.

Lastly, if things go sideways, you’ll want top-notch user support and service quality. Good help can fix things fast!

Catering to Novice Traders

Hey, if you’re new to this crypto world, no worries. The best crypto exchange for beginners is gonna make your start smooth. You don’t need all the fancy tools yet.

Look for exchanges with simple user experience crypto trading. It should feel as easy as playing a game on your phone. They should guide you on staking on crypto exchanges too, which helps you earn more coins just by holding them.

And what if you drop your phone in the pool? Exchanges have mobile trading apps crypto so you can trade on a new device pronto.

Every good start needs a friend. Exchanges with nice sign-up bonuses and promotions are like finding a buddy who gives you a high-five with a gift. It’s a warm welcome to trading!

So, choosing the right exchange? It’s all about what works best for you. Whether you’re new or an old hand at trading, the right features make all the difference. Keep your eyes open, use this guide, and you’ll find your perfect crypto trade spot.

Tackling the Financials: Fees, Rates, and Profitability

Understanding Exchange Fee Structures

Fees can eat your profits. Ever wonder why fees differ across crypto exchanges? Well, they have various ways to charge you. Some take a cut of each trade you make. Others take money when you move your cash in or out. And some even charge for holding your coins.

Let’s dive in. Each crypto exchange sets fees that work for its model. They might seem small, but they add up. When you’re picking an exchange, check these fees closely. They should be clear as day, no hidden stuff. Otherwise, you might pay more than you thought!

Evaluating Liquidity and Volume Metrics

Now, what about liquidity and trading volume? Imagine wanting to buy or sell a coin quick. If an exchange doesn’t have enough action, you might be stuck. Or worse, you could impact the price by your trade alone!

High liquidity means lots of trading. It’s a good sign for an exchange. More people trading equals better prices and quicker trades for you. You’ll want an exchange where you can jump in and out smoothly, with loads of supported cryptocurrencies. More coins mean more chances to trade.

And the volume? That’s how much trading happens. Big volumes tell you that many people trust the exchange. It’s like a busy market; you know it’s good because it’s packed.

Remember though, fees, liquidity, and volume are just part of the deal. You still need good security, support, and user experience. Don’t just chase low fees or high volume. Trust and service matter heaps, too. Plus, make sure it’s easy to use. If it’s too hard to figure out, is it really worth it?

There’s no one-size-fits-all crypto exchange. But knowledge is power. Use these insights to find the right fit for your trading style and wallet.

Security and Compliance: The Pillars of Trust

Prioritizing Robust Security Protocols

Choosing a crypto exchange? Look hard at their security measures. A top exchange must guard your digital assets like a fortress does its gold. So, what’s key? First, they should store most coins in cold wallets – offline and safe. They also need two-factor authentication (2FA) for a tight access gate.

Each platform has different tools for a security shield. The best ones watch 24/7 for any signs of a breach. It’s like having a guard dog that never sleeps. Top platforms also put your private keys in a vault no hacker can open. That’s what robust security protocols mean!

But let’s dive deeper. These platforms must encrypt your data, never leaving a door open for thieves. They also have insurance policies in case the worst happens. So your mind can rest easy knowing your crypto is insured.

Even with all this, what says a security policy really works? Their track record. Reviews and user experiences don’t lie. If a platform has a history of breaches, that’s a big red flag.

The Significance of Regulatory Compliance

Now, let’s talk rules. Crypto platforms must follow them to keep your investments safe. They should meet financial regulations. Why? To prove they are fair and square. When platforms adhere to these laws, it closes the doors to illegal activities. Think of it as a safe way for your crypto to grow.

For example, Know Your Customer (KYC) checks help fight fraud and money laundering. A platform should ask for ID when you sign up. They’re trying to know who’s who in their club.

The US has its own set of rules, like the Bank Secrecy Act (BSA). This is where platforms keep an eye out for shady deals. If they don’t, they could face huge fines.

In the European Union, there’s the General Data Protection Regulation (GDPR). It ensures your personal info stays private and secure on these platforms.

Finally, it’s not just about following the law in one country; global exchanges must respect rules worldwide. This gives traders peace of mind, no matter where they call home.

Selecting the best exchange is no small task, but solid security and strict compliance can help you trust your choice. So, before you dive into the crypto ocean, make sure your ship is leak-free and sails are set to the right standards!

The User Experience and Support Framework

Assessing Mobile Accessibility and User Interface

When you dive into the pool of crypto exchanges, one thing stands out: mobile access is a must. Let’s face it, we’re not always by our desks. Being able to trade on the go is like having a superpower. The best exchange for beginners offers this. They make sure their apps are easy peasy to use. Big buttons, clear menus, and zero confusion. You want to buy Bitcoin like you’re playing a game. Fun, fast, and simple.

Now look at user interface, or “UI” for short. This is the exchange’s face. A bad UI is like a puzzle with missing pieces. A great one feels like your favorite coffee shop. Everything’s where it should be. This makes or breaks your trading day. You find coins fast, trade them faster, and see your money without squinting. Check out the exchange’s app reviews. They tell you if it’s a hit or miss.

Quality of Service and User Support Systems

Support systems are like seatbelts for trading. Something goes wrong, you need a fix, and fast! Good support is a friendly chat away. Not all exchanges get this right, though. Some are quick and helpful, others are slow and make you frown. Ask around, read reviews — get the scoop on who’s doing it right.

User support matters big time. It’s like having a guide in a maze. Find an exchange that answers quick and knows their stuff. They should know crypto like the back of their hand. Clear, helpful answers beat “Please hold” any day. Plus, good service keeps you safe. It’s part of security, knowing someone’s there if things get iffy.

What about when it’s not urgent? You just want to learn or fix a small thing. The best platforms have a library of how-tos and FAQs. You get smarter every time you visit. Now that’s quality! They say time is money, so finding answers fast means more time for trading.

Your adventure in crypto starts with the right exchange. One that makes trading a walk in the park and has your back 24/7. MessageBoxIcon

In this post, we walked through the maze of choosing a crypto exchange. We looked at key features that all good platforms have and how they make trading easier for newbies. We dove into the nitty-gritty of fees, rates, and what drives profit. Security and complying with laws came next because without trust, what do we have? Lastly, we talked about what makes the user’s journey smooth and the support they get when things go south.

What stands out to me is how vital it is to pick the right exchange. Take the time to research and understand where you trade. A safe, low-cost, user-friendly platform can make the difference between success and headache. Remember, your choice now sets the stage for your trading future. Happy trading!

Q&A :

What are the key differences between top cryptocurrency exchanges?

When comparing top cryptocurrency exchanges, consider factors like fees, security features, user interface, supported cryptocurrencies, transaction limits, and customer support. Top exchanges also vary in terms of their regulatory compliance, availability in different countries, and additional services such as staking or margin trading. Always research and read reviews to understand how each platform might suit your trading needs.

How do transaction fees compare across popular crypto exchanges?

Transaction fees can be a deciding factor for many traders. They vary widely among popular crypto exchanges and are structured differently. Some may offer a flat fee, while others use a maker-taker model or adjust fees based on 30-day trading volume. It’s important to consider both trading and withdrawal fees, as well as any discounts available for using the exchange’s native token or for high-volume trading.

What security measures do top crypto exchanges implement?

Security is paramount in the world of cryptocurrency. Top exchanges typically offer two-factor authentication (2FA), encryption methods, cold storage of assets, and insurance in case of a breach. However, security measures can differ considerably, so it’s crucial to examine each platform’s specific protocols. Additionally, the track record of an exchange in handling past security incidents can be an indicator of its commitment to protecting users’ funds.

Which cryptocurrency exchanges offer the most types of cryptocurrencies?

The range of supported cryptocurrencies is a vital consideration. Some exchanges focus on providing a wide array of coins and tokens, offering hundreds of options for traders seeking diversity. Others prioritize a more select group of well-established cryptocurrencies. Before choosing an exchange, check if it lists the currencies you’re interested in and whether it frequently updates its selection.

Can beginners easily use the top-rated crypto exchanges?

Ease of use is often a concern for beginners in the crypto space. Many top-rated exchanges provide a user-friendly interface, educational resources, and demo accounts to help newcomers. Some platforms are designed with simplicity in mind, offering straightforward buy and sell options, while others cater to experienced traders with complex charting tools and advanced order types. Look for exchanges with a good balance between functionality and user-friendly design.