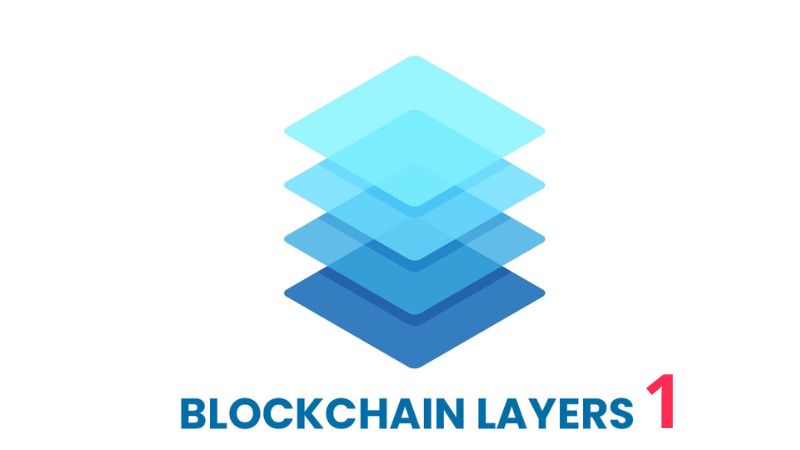

Blockchain Layer 1 refers to the foundational blockchains that are responsible for the primary functions of a decentralized network, including transaction validation, consensus mechanisms, and data storage. Examples of prominent Layer 1 blockchains include Bitcoin, Ethereum, and Solana. These blockchain networks serve as the backbone of decentralized applications (dApps) and digital asset transactions.

The primary strength of Blockchain Layer 1 lies in its ability to provide a secure and transparent environment for transactions without the need for intermediaries. Using consensus algorithms like Proof of Work (PoW) and Proof of Stake (PoS), Blockchain Layer 1 enables decentralized systems where participants can engage in trustless transactions, eliminating the need for a central authority. This decentralized nature ensures that no single party has control over the network, enhancing both security and transparency.

Blockchain Layer 1 is crucial not only for the operation of cryptocurrencies but also for the expansion of blockchain-based applications in various industries, including finance, supply chain management, healthcare, and more. By changing the way data is processed, stored, and verified, Blockchain Layer 1 is driving the transformation of global economic systems, enabling a new paradigm of transparency, security, and decentralization.

As the foundation for the broader blockchain ecosystem, Blockchain Layer 1 is also a key enabler of decentralized finance (DeFi), which allows individuals and businesses to engage in financial transactions without traditional intermediaries like banks. This shift towards decentralized financial systems is reshaping the global economy by promoting financial inclusion, reducing costs, and increasing the efficiency of cross-border transactions.

Blockchain Layer 1 and Its Role in Revolutionizing the Global Economy

Blockchain Layer 1 is fundamentally changing the global economic landscape by providing a decentralized, secure, and transparent infrastructure for various applications. By eliminating the need for intermediaries, blockchain networks enable peer-to-peer interactions, which streamline processes, reduce costs, and improve efficiency across industries.

One of the most significant impacts of Blockchain Layer 1 on the global economy is in the financial sector. With the rise of decentralized finance (DeFi), Layer 1 blockchains have created new opportunities for individuals and businesses to engage in financial transactions without relying on traditional banks and financial institutions. Through blockchain, users can now access financial services such as lending, borrowing, trading, and asset management in a trustless environment, leading to a more inclusive financial system.

In addition to transforming finance, Blockchain Layer 1 is also playing a crucial role in other industries like supply chain management, healthcare, and real estate. For example, in supply chains, blockchain enables real-time tracking and verification of goods, improving transparency and reducing fraud. In healthcare, blockchain can enhance data privacy and streamline patient records management. Similarly, in real estate, blockchain facilitates property ownership verification and makes transactions more efficient.

Furthermore, Blockchain Layer 1 facilitates the creation of digital currencies, which are slowly becoming an alternative to traditional fiat money. Cryptocurrencies like Bitcoin and Ethereum are not only challenging traditional currencies but are also providing a more efficient and secure means of transferring value across borders.

Overall, Blockchain Layer 1’s ability to provide an open, secure, and decentralized platform is revolutionizing various industries by increasing operational efficiency, enhancing transparency, and offering new avenues for economic growth. Its impact extends beyond finance, with the potential to transform multiple sectors and reshape global economic structures in the years to come.

Blockchain Layer 1 and Its Contribution to the Financial Industry

Blockchain Layer 1 is playing a pivotal role in transforming the global financial industry. With the advent of decentralized finance (DeFi), Blockchain Layer 1 has introduced a paradigm shift, allowing individuals and businesses to engage in financial activities without intermediaries like banks or traditional financial institutions. This transformation is creating a more inclusive, transparent, and efficient financial system.

DeFi, built on Layer 1 blockchains such as Ethereum, enables financial services like lending, borrowing, trading, and insurance through smart contracts and decentralized protocols. These services are available to anyone with internet access, significantly reducing barriers to entry for those who have been excluded from traditional banking systems. This has the potential to provide financial services to the unbanked and underbanked populations, especially in emerging economies, where access to traditional banking services is limited.

Moreover, Layer 1 blockchains are reducing transaction costs and increasing transaction speeds compared to traditional financial systems. For instance, cross-border payments, which traditionally involve high fees and long processing times, are now faster and cheaper through cryptocurrencies and blockchain technologies. This not only enhances the efficiency of financial transactions but also opens up new opportunities for global trade and commerce, as businesses and individuals can now transfer value seamlessly across borders without relying on banks or currency exchanges.

The use of Blockchain Layer 1 also promotes transparency in financial transactions, as all transactions are recorded on an immutable ledger. This reduces the potential for fraud and corruption, which has been a long-standing issue in the financial industry. Additionally, the decentralized nature of Layer 1 blockchains ensures that no single entity has control over the network, promoting trust among participants.

Furthermore, the rise of central bank digital currencies (CBDCs) is another testament to the growing influence of Blockchain Layer 1 in the financial industry. Many governments are exploring the use of blockchain-based digital currencies to modernize their financial systems and improve monetary policy implementation.

Blockchain Layer 1 is not only reshaping the way financial services are delivered but is also fostering innovation in the financial sector. By enabling a more decentralized, secure, and efficient financial system, Blockchain Layer 1 has the potential to drive significant economic growth and provide a broader range of financial opportunities to people around the world.

Blockchain Layer 1 in Supply Chain and Logistics

Blockchain Layer 1 is significantly improving the efficiency, transparency, and security of supply chains and logistics, which are essential components of the global economy. With the ability to provide real-time, immutable tracking and verification of goods, Blockchain Layer 1 is transforming how products move through global supply chains, enhancing accountability and reducing operational inefficiencies.

One of the key benefits of Blockchain Layer 1 in supply chain management is the ability to provide an immutable and transparent record of every transaction, from production to delivery. This allows companies to track the provenance of goods and materials, ensuring the authenticity and quality of products at each stage of the supply chain. For example, in industries like food, pharmaceuticals, and luxury goods, blockchain can provide verifiable proof of origin, helping to combat fraud, counterfeiting, and illegal trade. Consumers can also benefit from this transparency, as they are able to verify the source and sustainability of the products they purchase.

Blockchain Layer 1 also plays a crucial role in reducing delays and errors in logistics. By automating key processes through smart contracts, the need for manual intervention and paper-based documentation is minimized, streamlining operations and reducing the risk of human error. Smart contracts can automatically execute transactions and trigger actions based on predefined conditions, ensuring timely payments, accurate shipments, and more efficient inventory management.

Additionally, blockchain can enhance the security of sensitive data within supply chains. Traditional supply chains often rely on centralized databases, which are vulnerable to data breaches and cyberattacks. In contrast, blockchain’s decentralized nature ensures that data is securely stored and tamper-proof, reducing the risk of cyber threats and unauthorized access to critical information.

Another key advantage is cost reduction. By eliminating intermediaries, such as third-party verification agencies and clearinghouses, Blockchain Layer 1 enables businesses to reduce fees associated with transactions, documentation, and verification. This results in lower operational costs and higher profit margins for companies, while consumers benefit from more competitive pricing.

In the logistics industry, Blockchain Layer 1 helps streamline the management of transportation routes, inventory, and customs clearance. With a single, unified record accessible by all parties involved, companies can ensure smoother and more coordinated operations, speeding up delivery times and improving overall customer satisfaction.

Blockchain Layer 1 is revolutionizing supply chain management and logistics by providing a transparent, secure, and efficient platform for tracking goods and automating processes. By increasing accountability, reducing costs, and enhancing data security, Blockchain Layer 1 is poised to be a critical driver of growth in global trade and commerce, helping companies to operate more effectively and meet the demands of a rapidly evolving market.

The Future of Blockchain Layer 1 in the Digital Economy

As Blockchain Layer 1 continues to mature and evolve, its potential to shape the future of the global economy becomes increasingly clear. The technology is expected to address some of the current limitations of blockchain systems, such as scalability, energy efficiency, and interoperability. As new solutions emerge, Blockchain Layer 1 will likely play an even more significant role in the digital economy.

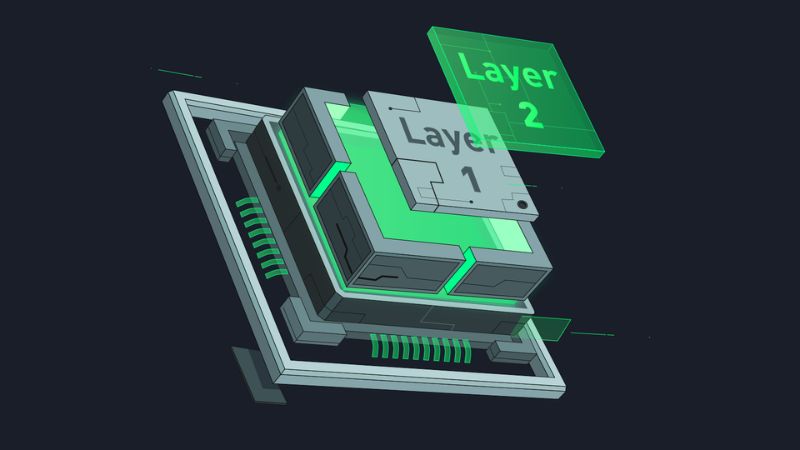

One key area of development is scalability. Current Layer 1 blockchains, like Bitcoin and Ethereum, face scalability challenges due to network congestion, high transaction fees, and slow processing speeds. However, several promising solutions, such as Ethereum 2.0 and the use of Layer 2 technologies, aim to increase transaction throughput while maintaining security and decentralization. These upgrades are expected to make Blockchain Layer 1 more efficient and capable of handling a larger volume of transactions, which will be critical as adoption grows across industries.

Another critical area for future development is energy efficiency. Blockchain networks, especially those using Proof of Work (PoW), have been criticized for their high energy consumption. However, Layer 1 blockchains that adopt Proof of Stake (PoS) and other consensus mechanisms are significantly reducing energy usage. Ethereum’s transition to PoS is one example of how Layer 1 blockchains can contribute to a more sustainable digital economy. As energy concerns become more pressing, the industry is likely to see a continued shift toward greener and more sustainable blockchain solutions.

Interoperability is also an important focus for Blockchain Layer 1. As multiple blockchain networks emerge, the need for seamless communication and interaction between different blockchain systems becomes more critical. Projects like Polkadot and Cosmos are working on cross-chain solutions that enable Layer 1 blockchains to communicate and exchange value more effectively. The development of interoperable blockchain ecosystems will promote greater efficiency, collaboration, and innovation, enabling new use cases across various sectors.

The growing integration of Blockchain Layer 1 into traditional industries is expected to accelerate in the coming years. Financial institutions, governments, and corporations are increasingly exploring blockchain as a solution for improving transparency, reducing fraud, and increasing efficiency. Central Bank Digital Currencies (CBDCs) are one example of how governments are leveraging blockchain technology to modernize financial systems. Blockchain’s ability to provide a decentralized and tamper-proof ledger is seen as a solution for improving the stability and security of national currencies in an increasingly digital world.

Blockchain Layer 1 also has the potential to play a pivotal role in the evolution of the Internet. As Web 3.0, the decentralized internet, continues to gain traction, Blockchain Layer 1 will serve as the backbone of a more user-centric, privacy-focused digital ecosystem. This could fundamentally alter the way individuals and organizations interact online, creating new economic models and opportunities for digital ownership, content creation, and data privacy.

The future of Blockchain Layer 1 is filled with immense potential for innovation and growth. As the technology evolves and overcomes current challenges, it is poised to become a central pillar of the digital economy. Blockchain Layer 1’s ability to provide secure, transparent, and decentralized solutions will drive the next wave of economic transformation, reshaping industries and enabling new possibilities for global commerce and digital interaction.

Blockchain Layer 1 has already proven itself as a game-changing technology with the potential to reshape the global economy. From its foundational role in decentralized finance to its impact on industries like supply chain management, healthcare, and real estate, Blockchain Layer 1 is driving innovation and efficiency across sectors. As scalability, energy efficiency, and interoperability continue to improve, Blockchain Layer 1 will become even more integral to the digital economy, enabling greater transparency, trust, and inclusion.

The transformative power of Blockchain Layer 1 lies in its ability to decentralize systems, eliminate intermediaries, and create secure, transparent networks. This will not only enhance the efficiency of global trade and financial systems but also contribute to a more inclusive and sustainable global economy. As the technology continues to evolve, it will unlock new opportunities for businesses, governments, and individuals alike, shaping the future of the global economy for years to come.